How does a 160-year-old investment bank attract a new generation of investors who expect high-tech and high-touch?

Morgan Stanley

The Objective

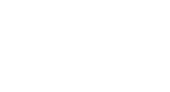

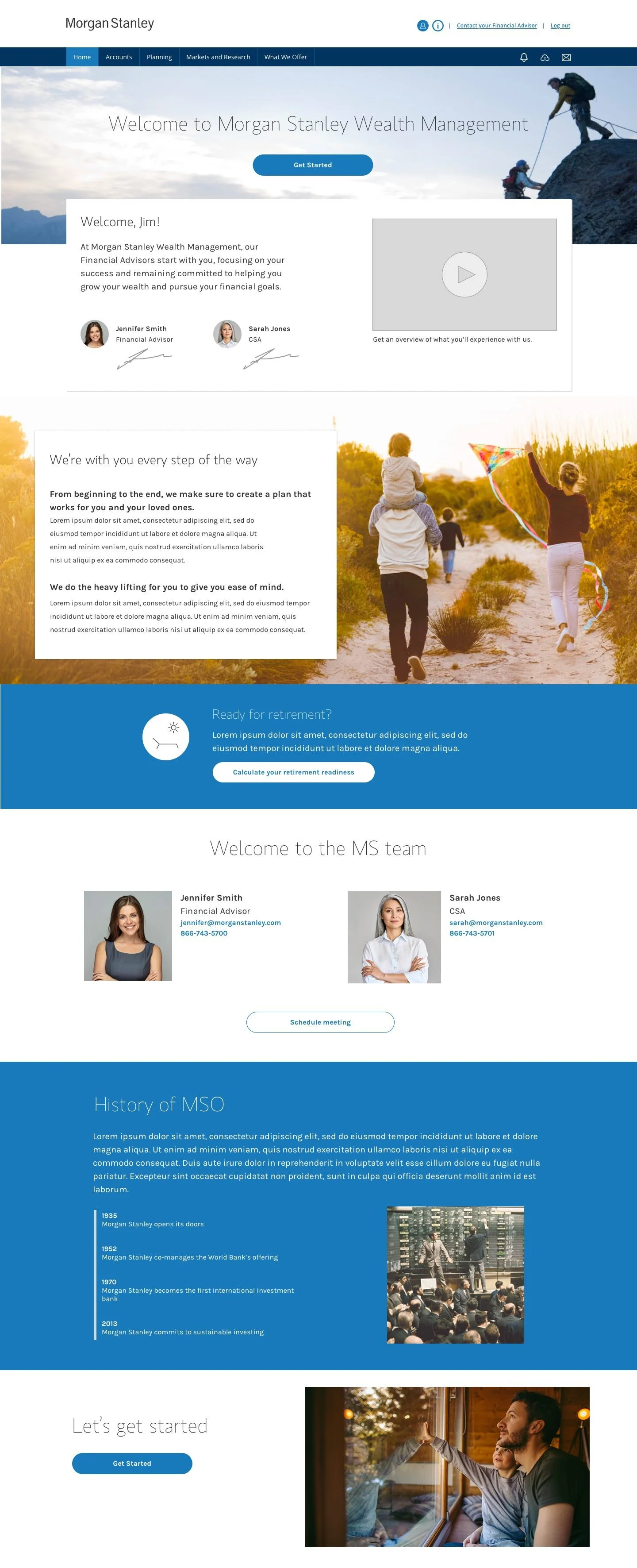

To create a fully digital onboarding process for new clients that would include document storage and digital signatures as well as a way for financial advisors and their clients to monitor the goals and progress of their investment strategies.

Who were we targeting?

-

Savvy investors who are leveling up

For these personas, we compiled research projects undertaken in 2018 as well as follow-ups done by my team in 2021.

Our target hadn’t changed much. They were confident, savvy Investors with assets ranging from $150k-$20m. They had moved from a place where they enjoyed having control over their portfolios to a level of complexity that required the assistance of an expert.

-

Dedicated Financial Advisors

There was extensive research done with Morgan Stanley’s advisors by a multitude of research teams. We were able to draw from all of their findings to establish their needs.

Across the board, we saw that one of the biggest time drains for FAs is the process of cultivating leads. These are high-net-worth individuals who very often have their own advisors already. If not, they were often secure in their own ability to manage their finances.

The goal was to demonstrate that Morgan Stanley has the technological advancement and the personal attention that they will require as their wealth grows in size and complexity.

What client and FAs were saying

“We want to be face-to-face with these people. We need to meld technology with what we do but it needs to be in a responsible way with our business.”

— Financial Advisor

“I think people understand it’s like death by papercut here.”

— Financial Advisor

“I like to think of myself as pretty serious and sophisticated when it comes to managing my money, but I want someone asking questions I don’t know to ask.”

— Eric, active trading investor

Learning where to start

-

We started off by creating a comprehensive org chart in order to know dependencies, partnerships, and the order and hierarchy of decision-making.

From this list, we began our stakeholder interviews.

Each of the group leaders understood a different aspect of the project and had a deep understanding of the technological hurdles it would take to solve the problem.

they knew it was important to focus on the next 5 to 10 years, but they were worried about evolving such complete systems across the organization.

-

We had access to a robust report created by the Morgan Stanley UX Research team in 2008.

We also repeated many of the questions to advisors working in the field right now. We cross-referenced the two data sets and found that the needs of advisors had not changed as much as the needs of the customers.

A streamlined onboarding process was still a must from both sides of the equation.

-

The Morgan Stanley UX team has access to industry-wide reports that pinpointed the specific features we were looking to employ.

They had already been vetted by industry experts. Even though MS was late to the game, we are able to avoid the pitfalls they have experienced due to their early adoption of things like fully-digital onboarding.

We were able to see what the competition was doing and then decide, based on our customer demographics, what would be a good fit for a future state.

In-depth journey maps helped identify gaps in service as well as unnecessary steps, which streamlined the service from 2 weeks to 2 days.

The Journey

-

We started a large service design blue-printing exercise to map all of the various systems that were being employed, and especially moments when processes were manual or taking too much time.

This blueprint became a single journey map that followed a prospective client and the FA hoping to complete their full onboarding. This allowed many internal groups to see where we could standardize elements so that so many different UX teams were not recreating the wheel.

-

We took the journey map and started creating wireframes that showed the full life cycle of the client, from first contact to fully-funded accounts.

-

The process of innovating from within the organization is different from my previous experiences. The design team gets a brief from the business team and then pitches it back to them to get funding.

The designs process must show desirability, feasibility, and viability to the executives that fund all new projects.

The Results

-

Research results from the advisors were overwhelmingly positive.

Onboarding times were reduced from weeks to days.

This onboarding process was then adopted by other divisions of the investment bank.

-

Clients that MS dealt with were a very specific kind of persona, and not necessarily the one we had imagined.

We had considered our ideal person to be a user who was very much involved with their finances and very tech-savvy.

This was sometimes the case, but what we didn’t realize was that when an investor passed the threshold from robo-advisor to dedicated one-on-one advisor, they wanted white-glove service and a lot of hand-holding.

-

Focus on removing the paperwork, but increase the face-to-face aspect of the onborading to build trust. Financial Advisors are like business partners and when such large sums of money are concerned, people do not want to deal with another website.